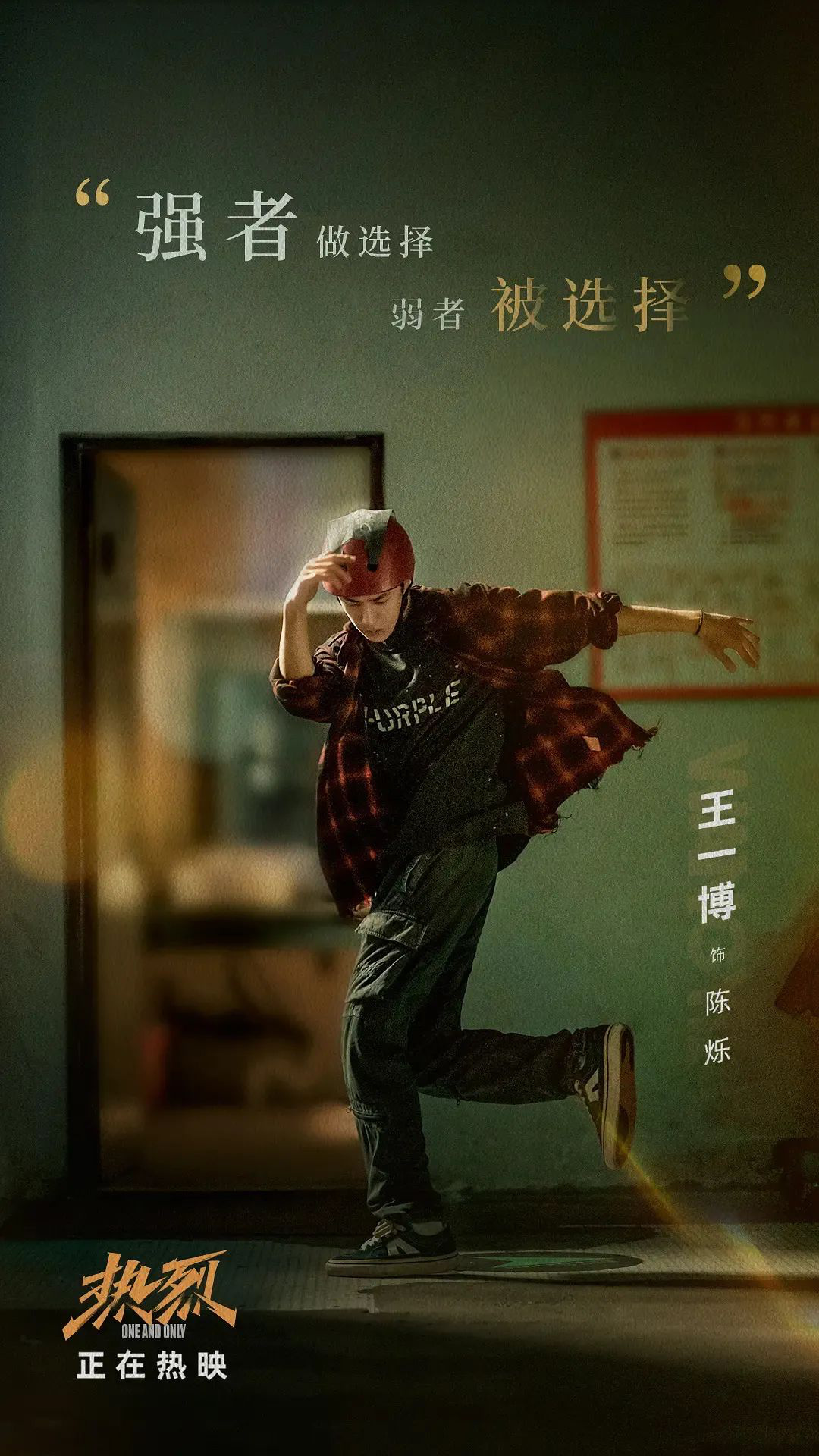

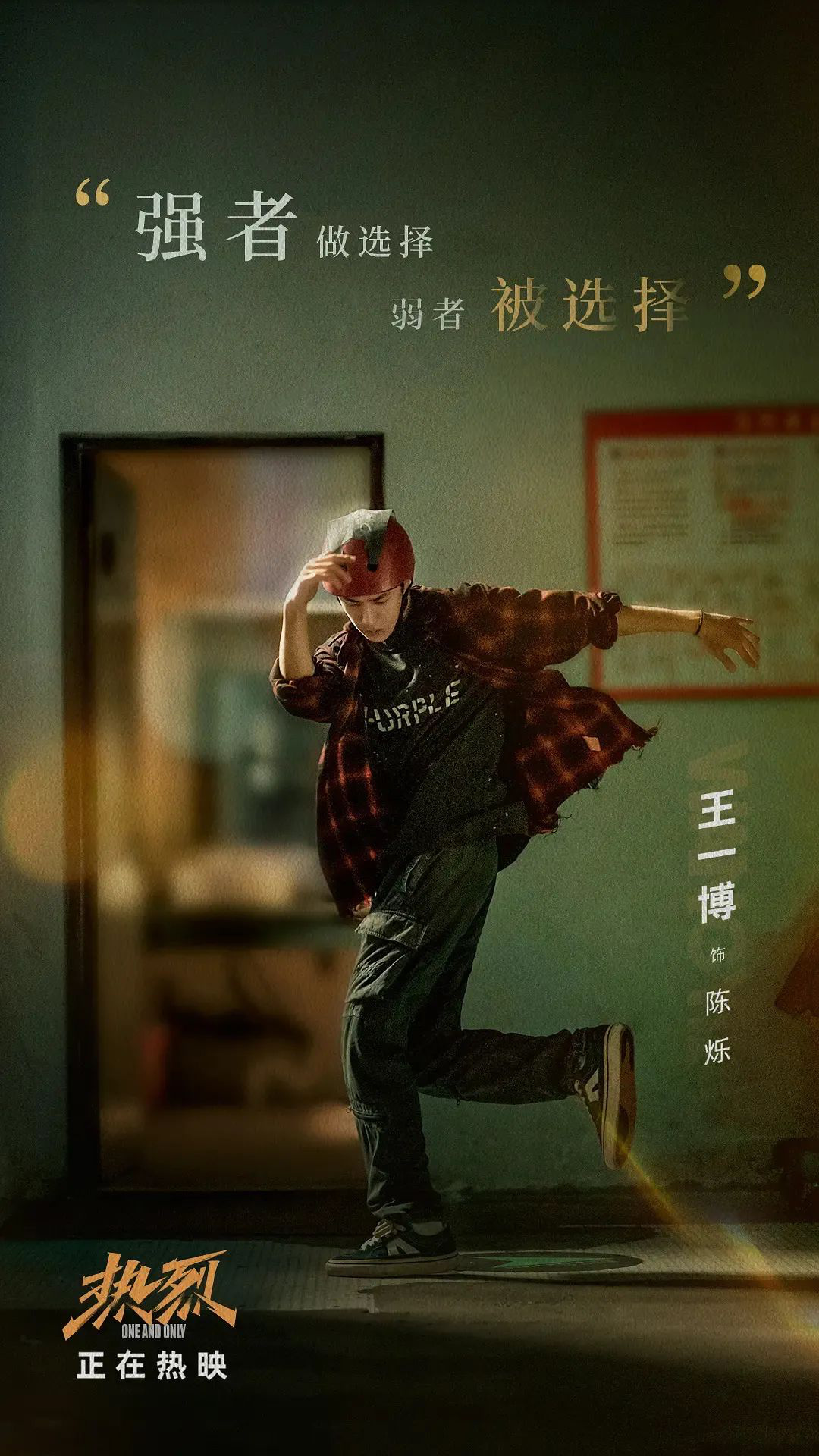

Special feature of 1905 film network From January, 2023 to April, and then to July, I worked as Mr. Ye, worked as Lei Yu, and finally went to Chen Shuo. Different from the previous two douban films, which were rated at 6.6, Enthusiasm is slightly higher than the previous film with a score of 7.2. At present, Cat’s Eye predicts that its box office is 1.015 billion, which is higher than Nobody (931 million) and King of the Sky (845 million).

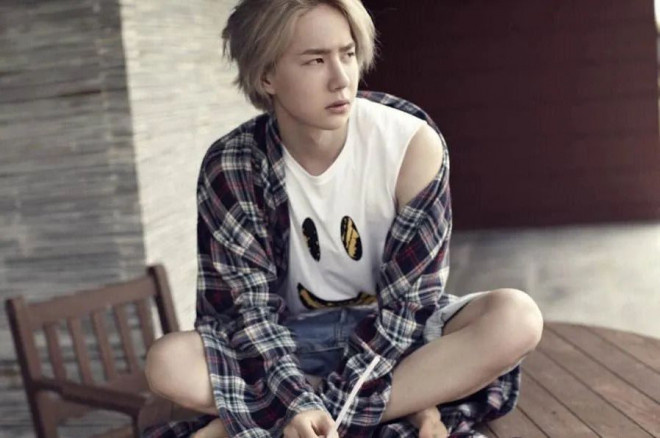

Actors from non-professional backgrounds usually play roles similar to their own experiences and personalities first, and then try new fields after polishing.As a traffic, YiBo’s influence can’t be underestimated, but the performance difficulty of the first two films is not entirely up to him, and the heat may even be counterproductive.

|

|

|

YiBo, whose acting skills and popularity need to be improved, walked out of a road opposite to others this time:Play as you are, and have an acting "retrograde".

Ben se dang hang

Whether in Nobody or King of the Sky, the role played by YiBo is very different from his original life. The age of "Nobody" is far away from him, and the life of "King of the Sky" is far away from him, but "Enthusiasm" just happened from his experience, and YiBo’s performance is more emboldened.

The director revealed in the backstage interview of the movie channel that "Enthusiasm" came into being only after YiBo. YiBo is not a trained man, nor is he a genius in acting. Instead, the biggest room for him to play is to "be himself". In Enthusiasm, he is not performing, but breathing and living on his own.

In the field of performance, there is a term called "true colors", which means that there is some tacit understanding between the role and the actor. If one word is used to describe Chen Shuo, it should be "hip-hop dream", and YiBo just fits it.

YiBo is a dancer in the debut men’s team UNIQ, and participated in "This! It is the recording of the three seasons of Street Dance, which has an excellent street dance foundation and can make difficult moves in line with the needs of the plot.

Chen Shuo, who loves street dance, started as a small car washer and finally became the champion of the national street dance competition. YiBo also had a similar experience. If in the movie, this dream is "street dance", then in reality, this dream becomes a "movie". In recent years, YiBo has been active on the screen, eager to firmly establish himself in the film circle.

The interaction between the inside and outside of the play can help the actors to understand the role portrait better, and it is also convenient for empathy and substitution. Reducing the difficulty and ensuring the quality, YiBo did the right thing this time.

Return to reality

After watching Enthusiasm, many people said that YiBo finally found the role that suits him best.

Even a mature actor, without a suitable role, the performance is still very passive. "Protecting people’s drama" often ends in a thankless outcome, but if it is "protecting people from drama", it will be much easier to perform silky and rich performances. Enthusiasm is a realistic, modern and hip-hop theme, which can be described as tailor-made for YiBo. At this moment, I have to thank Dapeng, a "Bole".

Chen Shuo never forgot to practice his movements on the last subway, and stubbornly pursued an unreachable dream. YiBo also began to learn dance in his teens, and once he became a big hit. He and Chen Shuo are like two sides of one body, film and reality, facing each other from afar.

YiBo’s return to the comfort zone to perform this time is a breakthrough. It is powerful to punch out after the fist is tightened. After finding himself in the comfort zone and honing his acting skills, the subsequent performance may be his real film road.

Dapeng tells and interprets little people, while YiBo plays himself.

Parallel time and space

Some people say that the ten years in "Enthusiasm" are the ten years that YiBo kept silent about. He has also gone through a "transparent" journey that is not optimistic, from the initial anonymity to the later fame. Chen Shuo is YiBo in parallel time and space.

As a "body double" and a "spare tire", Chen Shuo is always available and can be eliminated and abandoned at any time. In life, everyone will experience the process of being chosen, and every audience can see their own shadow from Chen Shuo.

Although we are the protagonists in our own lives, we are often a supporting role in society. In the face of complicated and complicated reality, do you need to listen to the call of your inner ideal? Continuing to pursue dreams is our choice in the parallel space-time of Enthusiasm.

Enthusiasm is a parallel time and space for every character. Zhang Cuibiao, who loves hip-hop, was not loved by hip-hop and finally chose to leave. Sometimes, you don’t have to work hard to succeed; Struggling on the wrong road, the harder you work, the farther away you will be from the finish line. Enthusiasm affirms the importance of hard work and the importance of choice. If what you love can’t be gained, who can guarantee that Chen Shuo won’t choose to be Zhang Cuibiao?

Many viewers will think of a moment they experienced in the cinema. The audience is like this, so are the actors. Apart from YiBo, Dapeng, Bo Huang and many other members of the creative team have all gone from supporting roles to leading roles.The role is for ourselves. We don’t have to envy parallel time and space, just find ourselves.

Kevin shook hands with Chen Shuo after hesitating. There are winners and losers in the game, but love is right and wrong.

As an actor, YiBo walked back to the "ID" from a difficult role and completed a retrograde performance. The retrogression of art is not a retreat, but a search.

The performance in the comfort zone can stimulate the potential and charm of the actors to the greatest extent. The collision of heat and dancing skills shaped Chen Shuo and gave YiBo a leap.

Go back to the starting point and wait for the future.