Asset Management Investigation Bureau 01 | Unfinished residential building? Rashomon? How can Baoneng weave a "real estate dream"

﹁

start

﹂

At 0: 30 on April 20th.

Four 20-story uncompleted residential buildings that stood on Zhenbei Road in Shanghai for nearly 20 years were demolished by blasting at the same time. A flaw in Shanghai’s "West Lobby" finally became history, and Zhenbei business circle ushered in a brand-new pattern.

At 0: 41 on April 20th.

After the first clarification by the Shanghai Seismological Bureau, the "Central Center Reconstruction Project" successfully went out of the circle and entered the people’s field of vision of the whole country;

April 22, 2020

Xu Guoliang, the original owner of the Central Center Project, reported that the receiver had embezzled assets, which immediately attracted many concerns. The renovation project of Zhenbei Business Circle in Putuo, Shanghai once again became a hot spot of public concern.

After many twists and turns, I entered the true north

Unfinished residential building?

The uncompleted residential buildings in this blasting are located in the Central Commercial Complex in the west of Shanghai and the main road of the Central Ring Road. They have changed owners several times in the past 20 years, but now they have been collected by Baoneng Group. The project name is tentatively "Baoneng Central Center", which will be built into an urban complex integrating office, commerce, hotels, entertainment and finance.

Photo: renderings of Baoneng Central Center

In 1997, No.1531 Zhenbei, where Baoneng Central Center is located, was the wife Aite of New Huangpu (600638, Guba), the largest super-large storage building materials distribution center in Shanghai. It covers an area of 270 mu, with a total construction area of 100,000 square meters and a total investment of 400 million yuan. The first phase of the project was completed in 1998, and it was sought after by many consumers at ultra-low prices through direct sales channels.

Then in 2002, Sichuan Xinglida Group took over the project development, but it was not completed due to the shortage of capital chain. In 2005, Bailian Group, Shanghai Dehong Investment and Shanghai Dade Investment Company jointly acquired Xinglida Group, and immediately launched the Bailian Central Plaza project, and completed the first phase of Bailian Central Plaza construction in 2006. The project entered the public’s field of vision as a multi-format business image such as shopping, catering, leisure, culture and entertainment.

Photo: Shanghai Bailian Zhonghuan Shopping Plaza

In the following eight years, the second phase of Bailian Central has been silent. Until 2014, 100% equity and creditor’s rights of Shanghai Xinglida Commercial Plaza Co., Ltd., which is wholly controlled by Bailian Group, were publicly listed and sold on the Shanghai United Assets and Equity Exchange. In May of the following year, Shanghai Hengyuan Real Estate will receive 8.91 billion yuan together with three projects including Shanghai Xinglida Project.

After Shanghai Hengyuan took over the project, it was originally planned to introduce multiple functions and formats such as office, heavy space, apartment, hotel, business and finance, and build it into an ecological circle integrating work, life and leisure, but it was not implemented until it was acquired by Baoneng Group. The project has been "unfinished" for nearly 20 years. Baoneng decided to demolish it by blasting because of its old building structure and potential safety hazards. With the blasting sound of nearly 15 seconds, Putuo Zhenbei business circle ushered in a new era.

After 20 years of unfinished business, once it is exhausted, the future of Central Center can be expected.

The curtain call of uncompleted residential flats

Rashomon?

On April 20th, the shock of Shanghai Putuo Zhenru attracted people’s attention. The disadvantages of Zhenbei business circle for more than ten years were blown up once, but there was a storm behind the aftermath. On April 22, Xu Guoliang, the original owner of the project, left the country with his lawyer, causing another storm. The saliva war with Baoneng and Shanghai Bank has once again sparked heated discussions.

Tracing back to the source of the war of words, in January this year, Xu Guoliang reported that the Bank of Shanghai "colluded" with Baoneng Group through the official micro-name of the enterprise, embezzled 20 billion excellent assets owned by Shanghai Hengyuan, and illegally obtained 26.5 billion yuan of loans from state-owned banks. On the same day, Shanghai Bank issued a statement, pointing out that the company under Xu Guoliang’s name owed huge debts and was seriously untrustworthy. It was sued to the court according to law, and Shanghai Bank reported the case as soon as possible for its use of the media to spread serious untrue statements.

The subsequent results are unknown, but with the demolition of Putuo’s "uncompleted residential flats" by blasting, this war of words has escalated again, each with its own basis and reason, and it seems to have evolved into a "Rashomon" for a while.

Hengyuan

Guo-Liang Xu

In September 2018, Shanghai Hengyuan made a deal with Shenzhen Fang Rui Investment and Shenzhen Langyun Investment and Hengyuan, which were introduced by Shanghai Bank. After signing an agreement and paying Hengyuan 300 million yuan, they changed their equity. The latter two companies failed to perform their duties as scheduled, and they occupied the construction site privately, falsely reported the loss of the company’s seal license, obtained the asset safe without consent, and went through the formalities of equity pledge.

Hengyuan believes that the two companies that signed the contract with it are shell companies of Baoneng, with their registered capital of only 10 million yuan, social security employee information of zero, no operating performance and basically zero performance ability, and there are serious violations in obtaining a loan of 12 billion yuan from Shanghai Bank, thus accusing Shanghai Bank of "colluding" with Baoneng Group to embezzle tens of billions of assets under its name.

Baoneng Company and Fang Rui Langyun have a close business cooperation relationship, such as investment, but there is no shareholding relationship and related relationship, and the personnel structure is not the same. It is not in line with the objective situation that Hengyuan Enterprise turned Fang Rui and Langyun into shell companies of Baoneng and their subordinate nominal acquirers.

Baoneng

group

In order to cover up the truth, confuse the audience and seek illegal benefits, Hengyuan has spread false statements from the media, and all the credit business granted by the bank to Baoneng Group is approved in the whole process according to the company’s approval authorization. The relevant credit does not belong to the approval authority of the vice president, and there is no illegal lending behavior.

Shanghai

bank

Baoneng, Shanghai Bank United Front, and Hengyuan hold their own words, each with its own reasons, and how to wait for the final judgment of the court.

After several leaps and bounds, no matter what the capital market says, No.1531 Zhenbei Road has been included in the bag of Baoneng Group. In the future, I only hope that Baoneng can make the hard-won Baoneng Central Center bloom with a brand-new style and become a new landmark in Putuo business circle that can assume the functions of the city.

Actively prepare for the layout listing.

Real estate dream?

On April 26th, Yao Zhenhua, the chairman of Baoneng Department, adjusted the structure of Baoneng Chengfa, and divided it into five regions, namely Guangdong-Hong Kong-Macao Greater Bay Area region, East China region, North China region, Southwest China region and Central China region, which laid the foundation for the later large-scale development. At the same time, the original listing plan for 2020-2021 was slightly delayed, and it is expected that Baoneng Real Estate will submit an IPO in Hong Kong in 2022.

For the layout of the real estate field, Baoneng has always had a special insistence.

Since 2012, Baoneng Real Estate began to expand rapidly for the whole country, covering 20 cities across the country in two years. However, because its layout area is mostly in the suburbs of second-and third-tier cities, the scale of real estate revenue growth is slow. In 2015, Baoneng Real Estate was merged into Baoneng Holdings, trying to expand its real estate business through equity acquisition. At the end of 2016, Baoneng Chengfa, which focuses on industrial real estate, was established in Shenzhen.

In 2017, the "Wanbao dispute" was settled, but Baoneng’s real estate dream continued.

In 2018, the listing plan of Baoneng Real Estate was exposed. According to its plan, Baoneng Real Estate will be listed in 2020-2021. It is estimated that by the end of 2022, the scale will reach the top eight in the industry, the profit will exceed 40 billion, and the company’s valuation will reach 500-700 billion. Vanke, the real estate company with the highest market value, has a market value of 363.7 billion yuan and a net profit of 38.87 billion yuan at the end of 2019. I have to say that the listing plan of Baoneng Real Estate is "grand".

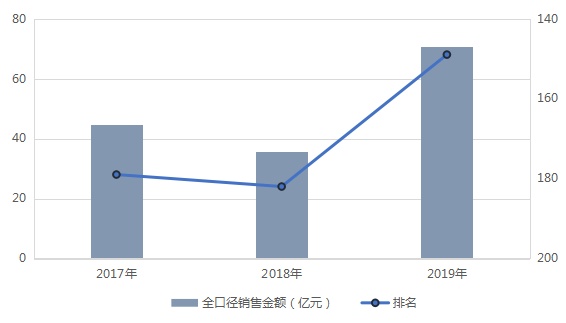

For the listing of the real estate sector, Baoneng has been actively preparing to expand its scale. In the sales performance list of typical real estate enterprises in China from January to December, 2019 released by Yihan think tank, Baoneng Holdings ranked 149th, and the sales amount of full-caliber commercial housing was 7.07 billion yuan, up 98.04% year-on-year, ranking 33rd.

Figure: The trend of sales amount of Baoneng Holdings in 2017-2019

Source: Yihan think tank

In recent years, Baoneng’s investment in real estate has been increasing. In 2019, Baoneng’s real estate business became clear again. The real estate development business was invested in Baoxin Land, and the industrial real estate business was dominated by Baoneng Chengfa. Recently, Yao Zhenhua has adjusted the structure of Baoneng Chengfa, actively set up a regional company of Baoneng Chengfa, and has made a preliminary construction of regional division. It is expected that three levels of control can be achieved in 2021-2022.

Figure: Business composition of Baoneng Real Estate Platform

Image source: real estate assets reference

The layout of industrial real estate and the establishment of Baoneng Chengfa are the practice of Yao Zhenhua’s concept of "prospering the city through industry". Under its vigorous promotion, the development model of "cultural tourism plus industry" has gradually formed. At present, many cultural tourism products recognized by the industry have been built, such as Yuan Wen Lion City in Qiandao Lake, Eighteen Ladders Traditional Scenic Area in Chongqing, and Baoneng Danxia Cultural Tourism City in Shaoguan, Guangdong.

With the endorsement of Baoneng Group, Baoneng Chengfa continued to innovate in industrial integration, integrating its multiple resources such as hotels, businesses, recreation and performing arts, and striving to build a blueprint for industrial real estate. By December 2019, Baoneng Chengfa had a management area of over 40 million square meters. On the road of large-scale development in the real estate field, Baoneng will be more active, and will continue to move towards listing in the future, and Baoneng’s real estate dream will be complete.

This article first appeared on WeChat WeChat official account: Real Estate Management Reference. The content of the article belongs to the author’s personal opinion and does not represent Hexun.com’s position. Investors should operate accordingly, at their own risk.