2023H1: Top10 in revenue ranking of multinational pharmaceutical companies.

With the disclosure of the financial reports of multinational pharmaceutical companies in the second quarter of 2023, we summarized the revenue, net profit and R&D expenses of the top 10 pharmaceutical companies in the first half of 2023.

Screenshot source: company financial report

In terms of revenue ranking, the Top10 revenues in the first half of 2023 are: Johnson & Johnson, Roche, Pfizer, Merck, Novartis, Abbey, Sanofi, Bristol-Myers Squibb (BMS), AstraZeneca and GlaxoSmithKline (GSK). Among them, Roche, Pfizer, Merck, AbbVie, BMS and GSK experienced negative growth.

In terms of net profit, Roche earned the most, nearly 8.7 billion US dollars. Followed by Pfizer, Johnson & Johnson and Novartis. It is worth noting that Merck lost nearly $3.2 billion in 2023H1.

Judging from the R&D expenses, Merck 2023H1 R&D expenses reached 17.6 billion US dollars, far exceeding those of Johnson, Roche and AstraZeneca.

JNJ

Screenshot Source: Company official website

On July 20th, Johnson & Johnson released the Q2 financial report for 2023: revenue was $25.53 billion, a year-on-year increase of 6.3%. Among them, the revenue of the pharmaceutical sector was 13.731 billion US dollars, a year-on-year increase of 3.1%; Pharmaceutical business accounts for 54% of the total revenue, which is the highest and fastest growing sector of Johnson & Johnson. So far, Johnson & Johnson’s total revenue in 2023H1 was US$ 50.276 billion, a year-on-year increase of 6%.

As far as products are concerned, the sales of two core products of Johnson & Johnson, Stelara and Darzalex, totaled nearly $10 billion in the first half of the year.

In addition, the sales volume of the BCMA CAR-T product Carvykti (Sida Chiolense) in cooperation with Legendary Bio reached US$ 189 million in the first half of the year, and it is expected to achieve sales volume of about US$ 480 million this year.

Roche

Screenshot Source: Company official website

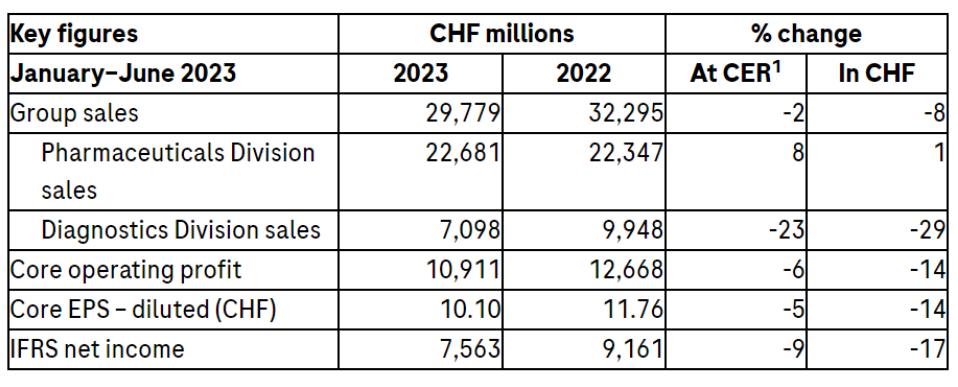

On July 27th, Roche released its financial report for the first half of 2023: the Group’s global revenue was 29.779 billion Swiss francs (about 34.2 billion US dollars, calculated at the exchange rate of 1 Swiss franc ≈ 11493 US dollars), down 2% from the previous year. The net profit was 7.563 billion Swiss francs, a year-on-year decrease of 9%; R&D investment was 6.449 billion Swiss francs, up 8% year-on-year.

The tumor field is still Roche’s main position, contributing 9.775 billion Swiss francs, but the growth rate is slowing down.

Among them, Roche’s pharmaceutical sector increased by 8% year-on-year in 2023H1. Among them, the new anti-Vabysmo drug launched in early 2022 once again became the main driving force for growth, with sales of nearly 1 billion Swiss francs.

In addition, the top five drugs in pharmaceutical business in 2023H1 were: Vabysmo, Ocrevus (multiple sclerosis), Hemlibra (hemophilia), Evrysdi (spinal muscular atrophy) and Phesgo (breast cancer), which contributed a total of 7.5 billion Swiss francs in sales, up 42% year-on-year.

Pfizer

Screenshot Source: Company official website

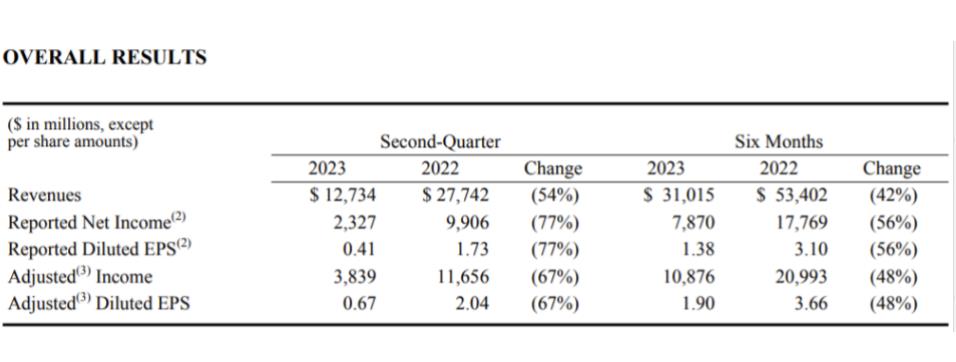

On August 1st, Pfizer announced its 2023H1 results, with revenue of $31 billion, a year-on-year decrease of 42%. Among them, the revenue in the second quarter was US$ 12.7 billion, down 54% year-on-year. The decline in performance was mainly due to the decline in demand for oral drugs Paxlovid in COVID-19 and Comirnaty in COVID-19.

Although there was a significant year-on-year decline, last year, with the income from vaccines and oral drugs, Pfizer achieved a revenue of 100 billion US dollars, which has been invested in acquisitions and introduction transactions, accumulating stronger comprehensive strength and post-development for Pfizer’s long-term development.

In terms of products, the RSV vaccine just approved by Pfizer is expected to grow into a super blockbuster, and the pneumonia combined vaccine will be listed at 20 prices and iterated at 13 prices. Ibrance, Xtandi related products, and Inlyta contributed the highest sales volume, with 1.25 billion, 310 million and 260 million respectively.

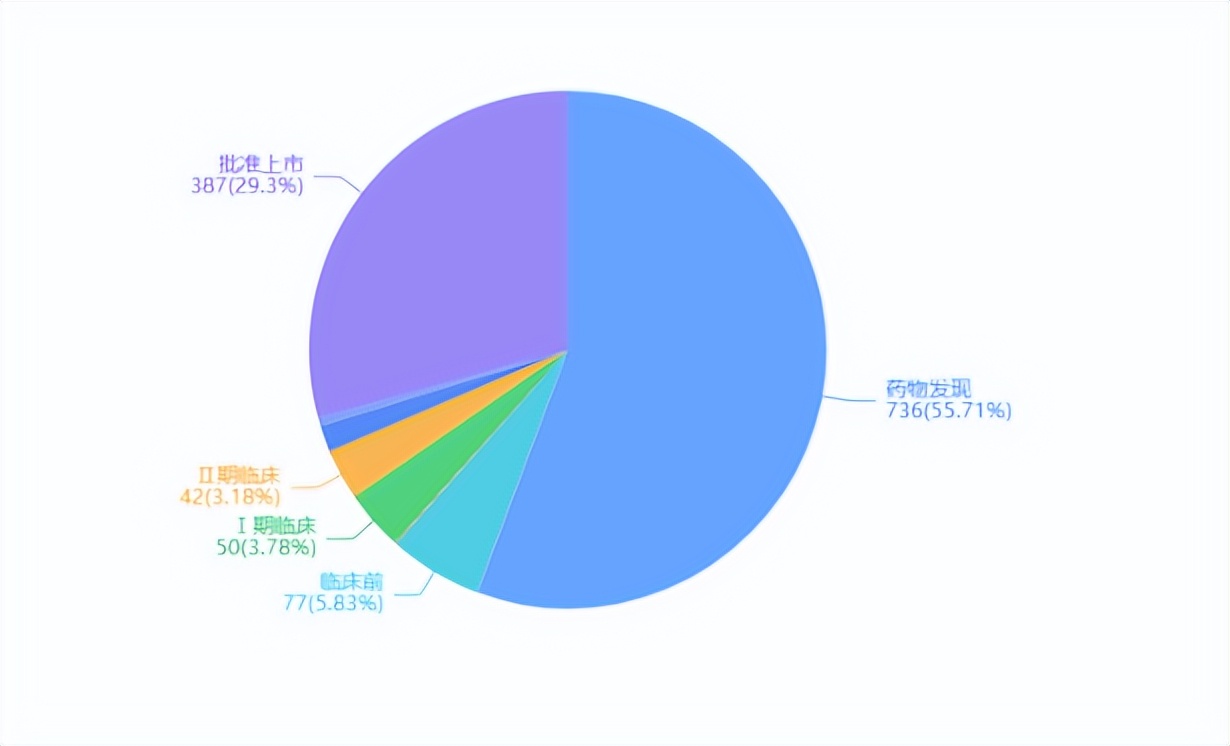

Screenshot Source: Drug Rong Yun Global Drug R&D Database

Pfizer said that the newly listed and expected listed pipelines will provide higher revenue for the second half of the year, while there are still uncertainties about COVID-19 products, which are expected to be eliminated by the end of the year.

Merck

Screenshot Source: Company official website

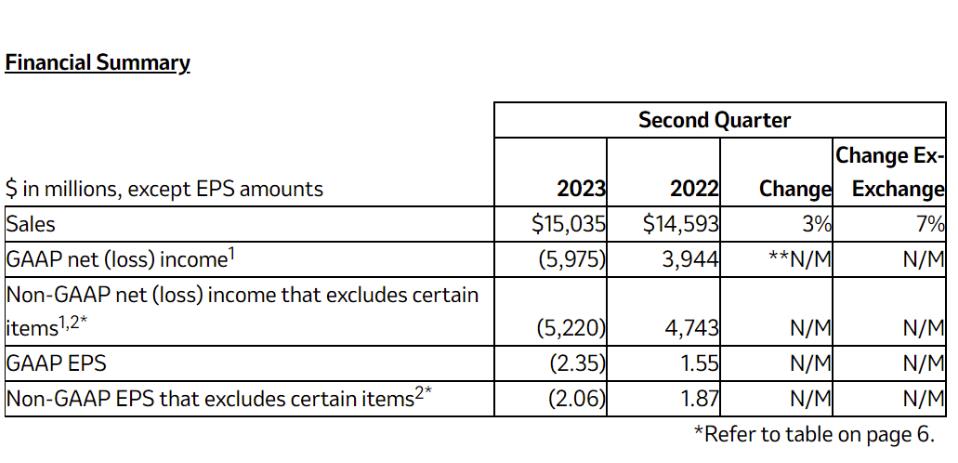

On August 1st, Merck released its second-quarter financial report, with revenue of $15.035 billion, a year-on-year increase of 3%. As a result, the total revenue in the first half of the year was $29.522 billion, down 3% year-on-year. Among them, the income from pharmaceutical business was US$ 26.179 billion, down 3% year-on-year, of which the income from China District was US$ 3.581 billion, up 13.7% year-on-year. R&D expenditure was US$ 17.6 billion, up 227% year-on-year.

In terms of products, the sales of K drug, Keytruda, continued to hit a record high in the first half of the year, reaching US$ 12.065 billion, up 20% year-on-year; Annual sales are expected to reach a new height and reach the top of the "drug king" throne. The sales of HPV vaccine Gardasil in the first half of the year was US$ 4.43 billion, a year-on-year increase of 47%. The total revenue of the two products was $16.495 billion, accounting for 63% of the pharmaceutical business income. However, Humira was hit by bio-similar drugs, and the market shrank rapidly.

In the field of vaccines, Merck’s follow-up heavy products include pneumonia conjugate vaccine. The sales of 15-valent pneumonia conjugate vaccine in the first half of the year was 274 million US dollars, and 21-valent pneumonia vaccine just announced the success of Phase III clinical trial.

References:

1. Financial reports of companies

2. Rong Yun database.

<END>