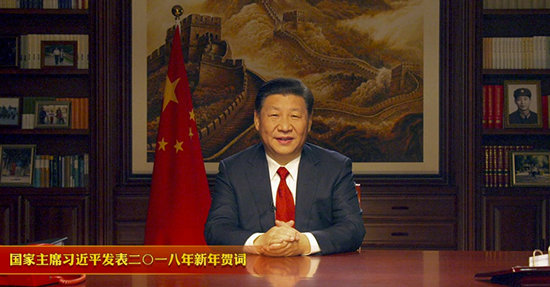

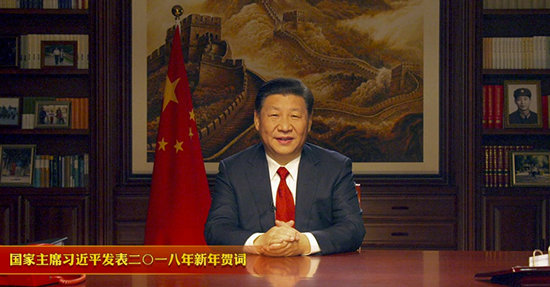

CCTV News:As the bell of the 2018 New Year is about to ring, the annual New Year message from the Supreme Leader of president arrives as scheduled. This is the fifth time that the Supreme Leader has delivered a New Year message since he took office in president, and it is also the first New Year message after Socialism with Chinese characteristics entered a new era.

Looking back on the New Year greetings of the Supreme Leader in the past five years, "people" is undoubtedly a high-frequency word. In the New Year message in 2014, "people" appeared 9 times, 16 times in 2015, 12 times in 2016 and 10 times in 2017. This time, the New Year message "people" appeared 14 times and "masses" appeared 6 times, which fully shows the weight of "people" in the hearts of the supreme leader.

Do not forget your initiative mind does practical things for the people.

Recently, "Sun’s 18-year-old photo" swept the circle of friends, and many people were moved by their own or others’ memories of youth.

Photos of the supreme leader’s youth also appeared in this New Year message video. In his youth, the Supreme Leader went to the countryside of northern Shaanxi as an educated youth and stayed there for seven years. There, dams, roads, biogas and terraces are built … … Do all kinds of hard work. In the eyes of the villagers, the supreme leader is a "hard-working, good young man."

Supreme leader’s youth military uniform photo

The Supreme Leader recalled in an article: "When I came to the Yellow Land at the age of 15, I was lost and confused; When I left the yellow land at the age of 22, I had a firm goal in life and was full of confidence. As a public servant of the people, the northern Shaanxi Plateau is my root, because it has cultivated my unchanging belief: to do practical things for the people! "

Everything goes forward, and we must not forget the road we have traveled; No matter how far you go, you can’t forget the past and why you set out.

From Shaanxi to Beijing, from Hebei to Fujian, from Zhejiang to Shanghai, from the grassroots to the party and state leaders, and the supreme leader who came out of the yellow land, the initial intention of "let the folks live a good life" is consistent.

"Keep the safety of ordinary people in mind at all times, take the benefit of the people as the greatest achievement, think about what the masses think, worry about what the masses are anxious, and make people’s lives happier." This is the supreme leader’s earnest expectation for Party committees, governments and cadres at all levels in his New Year message, and it also declares his determination to lead the Communist Party of China (CPC) to govern for the people.

In the past 2017, China’s GDP reached 80 trillion yuan, more than 13 million new jobs were created in urban and rural areas, more than 900 million people were covered by social old-age insurance, 1.35 billion people were covered by basic medical insurance, and more than 10 million rural poor people were lifted out of poverty, and 3.4 million poor people moved out of poverty and had warm new homes. 6 million sets of target tasks were completed ahead of schedule in the number of shantytown renovation projects. The development of various livelihood undertakings has been accelerated, the ecological environment has been gradually improved, and the people have more sense of gain, happiness and security.

Think what the masses think and be anxious about what the masses are anxious about.

"I understand that the people are most concerned about education, employment, income, social security, medical care, old-age care, housing, environment and other things. Everyone has a lot of gains, but also a lot of worries and troubles."

The word "understanding" embodies the ruling style of the supreme leader who loves the people and the people.

What the people need, what they do. Since the 18th National Congress of the Communist Party of China, the supreme leader’s investigation and research has spread all over the country, and his footprints have been left in communities, villages, enterprises, schools and troops.

"Go to the places where the masses need it most to solve problems, and go to the places where development is most difficult to open up the situation." In 2013, the supreme leader said this sentence in Gansu, which made the people-oriented thought of a big country leader deeply rooted in the hearts of the people.

Demo is higher than loving the people. In the grass-roots investigations again and again, the top leaders took the lead in setting an example, showing in detail how leading cadres should be close to the people and love the people. Baoding, Hebei province, he talks with villagers in a poor village deep in Taihang Mountain. In Lanzhou, Gansu, he served a meal for a 70-year-old man in a restaurant; In Hainan, he happily put on the hat handed by the Li people; In Xuzhou, Jiangsu Province, he spent 30 yuan to buy the villagers’ handmade sachets, and gave them to the 80-year-old villagers … …

Poverty alleviation is the most touching "people’s feelings". The rate of poverty reduction of more than 10 million a year is a miracle in China and even in the history of the world.

The supreme leader once said: as long as there is still a family and even a person who has not solved the basic living problems, we can’t be comfortable; As long as the people’s longing for a happy life has not come true, we must unite and lead the people to struggle together.

In February 2016, the Supreme Leader made an investigation in Jiangxi. In the poor household Zhang Chengde’s home, the supreme leader went room by room to see how he ate, whether he lived warmly and how many channels he could watch on TV. (Source: Xinhua News Agency)

In the face of the difficult masses, the supreme leader has always been modest and amiable. In 2016, when he was investigating in Jiangxi, he came to the home of poor household Zhang Chengde, inspected the kitchen, bedroom, sheepfold, doll fish pond and flush toilet. Zhang Chengde’s wife took the hand of the general secretary and said excitedly, "Thank you for coming to see us. You are the head of the country." The supreme leader took over the conversation and said, "The people are the masters of the country, and we are the servants of the people to help you run your errands."

In the course of the visit, we found the details that need to be improved, and the supreme leader will personally propose solutions. When investigating in Zhangjiakou, Hebei Province, he gave advice to the planning of local farmyard, and proposed that the living area, production area and breeding area of the house should be rationally laid out, the problem of toilet improvement should be scientifically designed, and public opinion should be respected.

Asking what is needed by the people solves people’s worries and warms people’s hearts.

"By 2020, the rural poor will be lifted out of poverty under China’s current standards!" On the road to a well-off society in an all-round way, the supreme leader has a far-reaching plan. By 2020, there will be only three years, and the whole society should take action, make the best of it, make precise policies, and constantly win new victories.

There is no doubt that winning the battle against poverty as scheduled in three years will be the first time in the history of the Chinese nation for thousands of years to eliminate absolute poverty as a whole, which is of great significance to the Chinese nation and the whole mankind.

Building a community of human destiny for the benefit of people all over the world.

"Sharing" is undoubtedly a "hot word" in 2017.

"Our great development achievements are created by the people and should be shared by the people."

Heaven rewards diligence and changes with each passing day. In 2017, China held the The 19th National Congress of the Communist Party of China, which painted a beautiful blueprint for Socialism with Chinese characteristics in the new era and started a new journey of building a socialist modern country in an all-round way.

A nine-story platform starts from tired soil. Looking forward to the new year, we will continue to make efforts to build a well-off society in an all-round way, implement the 13 th Five-Year Plan and comprehensively deepen reforms. As the supreme leader said in his New Year message: "Don’t dwell on fantasy, don’t dwell on empty voices, do a good job step by step."

The people of China are concerned about the future of their own country and the future of the world. Not only do you want to live well, but you also want people of all countries to live well.

In 2017, China hosted many home-based diplomatic activities, including the first Belt and Road International Cooperation Summit Forum, the meeting of BRICS leaders in Xiamen, and the high-level dialogue between the Communist Party of China (CPC) and world political parties. At the same time, the top leaders also participated in many important international multilateral conferences.

On these different occasions, the supreme leader has in-depth exchanges with all parties to promote the building of a community of human destiny for the benefit of people all over the world.

In the five-year New Year message, the Supreme Leader sincerely hopes that people all over the world will understand and help each other in the process of realizing their dreams, and strive to build the earth on which we live into a common and beautiful home.

The world is a family. In his New Year message, the Supreme Leader pointed out: China firmly upholds the authority and status of the United Nations, actively fulfills its due international obligations and responsibilities, abides by its commitment to tackling global climate change, actively promotes the joint construction of the Belt and Road Initiative, and always remains a builder of world peace, a contributor to global development and a defender of the international order. The people of China are willing to work with the people of other countries to create a more prosperous and peaceful future for mankind.

The bell of the new year has rung and a new chapter is about to open! In the new year, with respect for the people and care for all mankind, the CPC Central Committee with the Supreme Leader as the core will continue to unite the majestic strength of the Chinese nation, uphold the concept of a community of human destiny, and continue to make unremitting efforts for the great rejuvenation of the Chinese nation and the better life of all mankind. (Text/Lin Kongshi)