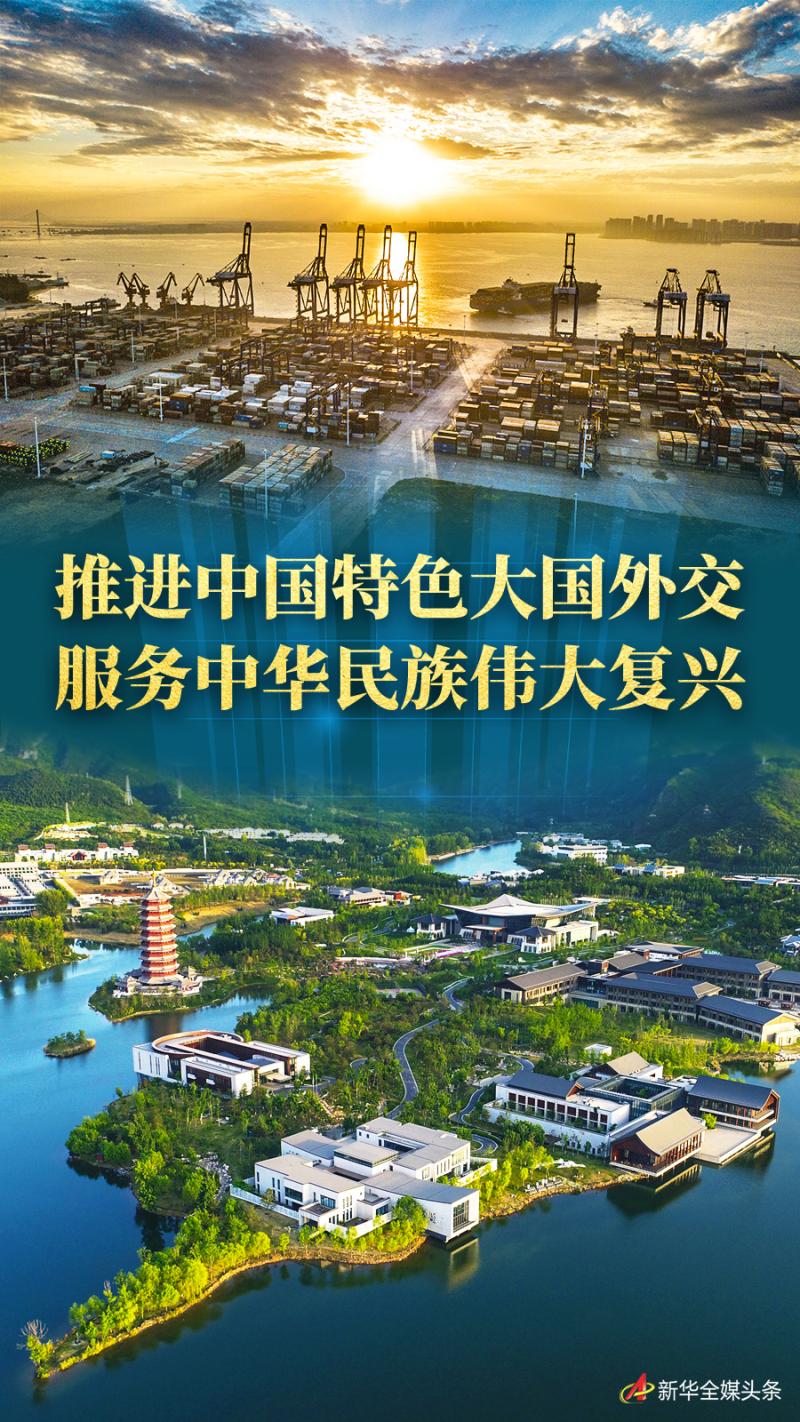

General Secretary of the Supreme Leader clearly pointed out at the November 2014 Central Foreign Affairs Working Conference that China must have its own characteristics of great power diplomacy. At the Central Foreign Affairs Working Conference in June 2018, General Secretary of the Supreme Leader further emphasized that the mission of realizing the great rejuvenation of the Chinese nation is to promote the diplomacy of a big country with China characteristics.

Since the 18th National Congress of the Communist Party of China, the CPC Central Committee with the Supreme Leader as the core has profoundly grasped China’s historical position and international situation, coordinated both domestic and international situations, led China’s foreign work to overcome difficulties and forge ahead, and embarked on a new diplomatic road with China characteristics as a big country, creating a good external environment for achieving the goal of "two hundred years" and realizing the Chinese dream of the great rejuvenation of the Chinese nation.

Develop global partnership and expand the intersection of interests with other countries.

On September 15, 2022, the Chairman of the Supreme Leader held a bilateral meeting with Belarusian President Lukashenko while attending the Samarkand Summit of the Shanghai Cooperation Organization in Uzbekistan. The two heads of state decided to upgrade the positioning of China-Belarus relations to an all-weather comprehensive strategic partnership, which is the latest development of China’s global partnership.

"Like-minded, is a partner. Seeking common ground while reserving differences is also a partner. " The Chairman of the Supreme Leader creatively proposed to build a global partnership based on deepening the diplomatic layout.

Adhering to dialogue instead of confrontation and partnership instead of alliance, China has made many friends and deepened cooperation with other countries over the past decade, constantly expanding the intersection of interests with other countries, and building a new type of international relations has become wider and wider.

Promote coordination and cooperation among major powers and build a framework for relations between major powers with overall stability and balanced development; Deepen relations with neighboring countries in accordance with the concept of sincerity and tolerance and the neighboring diplomatic policy of being good neighbors and partners; Uphold the correct concept of justice and interests and the true concept of sincerity, and strengthen unity and cooperation with the vast number of developing countries … … In the new era, China’s foreign relations have been continuously expanded and deepened, and the all-round, multi-level and three-dimensional layout of foreign work has been increasingly developed and improved.

On March 28th, 2020, at Islamabad International Airport, the staff unloaded the medical treatment materials donated by China. Xinhua News Agency reporter Liu Tianshe

At 12 o’clock on December 31, 2021, Managua, the capital of Nicaragua, was scorching in the sun. Accompanied by the majestic March of the Volunteers, a five-star red flag slowly rises in the center of the courtyard of the Embassy of China in Nicaragua.

Gambia, Sao Tome and Principe in 2016; Panama, 2017; In 2018, Dominica, Burkina Faso and El Salvador; In 2019, Solomon Islands and Kiribati; In 2021, Nicaragua … … Since the 18th National Congress of the Communist Party of China, nine countries have established and resumed diplomatic relations with China, and the number of countries with diplomatic relations in China has increased to 181.

Establish "China-Sweden Innovation Strategic Partnership" with Switzerland, open "China-Russia Comprehensive Strategic Cooperative Partnership in the New Era" with Russia, develop "China-Kazakhstan Permanent Comprehensive Strategic Partnership" with Kazakhstan, and continue to promote "China-India Closer Development Partnership" with India … … China’s partnership forms are more diverse, the connotation is constantly enriched, and the level is constantly improving.

This is the fan of Zanatas wind farm in Kazakhstan, which was taken on September 13th, 2022. Xinhua News Agency (photo by Dmitry Vasilenko)

The partnership advocated by China insists on mutually beneficial cooperation, gives full play to their respective advantages, turns winner-take-all into a win-win situation for all parties, expands the cake of common interests through cooperation, and realizes common development and prosperity.

Promote open cooperation and open up a broad space for common development

On August 31, 2022, with the whistle sounded, a China-Laos Railway international freight train loaded with tea, fertilizer raw materials and other goods set off from Jiangyin Port in Fuzhou for Vientiane, Laos, and Fujian started the first China-Laos Railway international freight train.

As the flagship project of "One Belt, One Road" jointly built by China and Laos, the opening of China-Laos Railway has not only made Laos’ dream of changing from a "land lock country" to a "land link country" come true, but also opened up a shortcut from the mainland of China to Laos and Southeast Asia by land.

In the autumn of 2013, the Chairman of the Supreme Leader proposed a major initiative to jointly build the Belt and Road Initiative during his visit. Insist on discussing, building and sharing, China will promote the high-quality development of the Belt and Road Initiative, implement a more proactive opening-up strategy, form a wider, broader and deeper opening-up pattern, and build a mutually beneficial, multi-balanced, safe and efficient open economic system.

This is the port of Piraeus, Greece, which was photographed by air on January 16, 2019. Xinhua News Agency reporter Wu Lushe

On February 27th, 2016, a special train stopped at the entrance of Kamchik Tunnel on the Anglian-Papu Railway in Uzbekistan. Xinhua News Agency reporter Shadati photo

In the past nine years, more than 140 countries and 30 international organizations have signed more than 200 cooperation documents with China to jointly build the "Belt and Road"; From 2013 to 2021, the accumulated trade volume of goods between China and countries along the route was nearly 11 trillion US dollars, and the two-way investment exceeded 230 billion US dollars; By the end of 2021, China had built 79 foreign trade and economic cooperation zones in 24 countries along the route, with a cumulative investment of 43 billion US dollars, creating 346,000 local jobs … … Crossing different regions, different stages of development and different civilizations, building the "Belt and Road" has been deepening and deepening, opening up a road of opportunity for all countries to achieve common prosperity.

This is a fireworks display at the opening ceremony of the Peleshac Bridge, which was filmed in Comar, Croatia on July 26th, 2022. Xinhua News Agency reporter Li Xuejun photo

China sets the stage, the world chorus.

This is the 50-day countdown to the 5th China International Import Expo(CIIE) and the signing ceremony of the 6th China International Import Expo(CIIE), which was filmed at the National Convention and Exhibition Center (Shanghai) on September 16th, 2022. Xinhua News Agency reporter Fang Yushe

September 2022, Shanghai. On the occasion of the 50-day countdown to the opening of the 5th China International Import Expo, many enterprises and institutions have locked the booths of the 6th China International Import Expo(CIIE) in advance. The "Expo Entry Story" pushed forward by stubble reflects the full enthusiasm of all parties involved, and shows China’s firm determination to "open the door wider and wider" and its sincerity to share market opportunities with other countries in the world.

The audience visited the comprehensive exhibition hall of China International Fair for Trade in Services National Convention Center in 2022 (photo taken on September 5, 2022). Xinhua News Agency reporter Hao Zhao photo

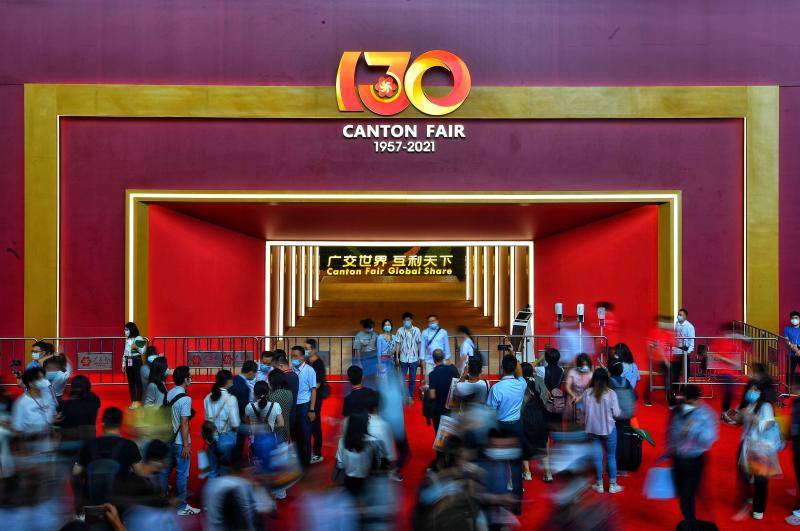

Exhibitors at the 130th Canton Fair (photo taken on October 15th, 2021). Xinhua News Agency reporter Liu Dawei photo

From holding China International Import Expo(CIIE), Service Trade Fair, Canton Fair and Consumer Expo year after year, to coordinating the construction of 21 pilot free trade zones, and then building Hainan Free Trade Port with high quality and high standards; From actively promoting the formal entry into force of the Regional Comprehensive Economic Partnership Agreement, to formally applying to join the Comprehensive and Progressive Trans-Pacific Partnership Agreement, and then promoting the development of economic globalization in a more open, inclusive, inclusive, balanced and win-win direction … … In the new era, China has opened its arms to the world, promoted the construction of an open world economy, and shared development opportunities and gathered development forces in China’s integration with the world.

This is the location of the 2nd China International Consumer Goods Expo, which was shot in Haikou on July 30th, 2022. Xinhua News Agency reporter Guo Chengshe

Upholding the concept of diplomacy for the people and safeguarding the legitimate rights and interests of overseas China citizens and legal persons.

On the evening of September 25th, 2021, after unremitting efforts, Ms. Meng Wanzhou, who was illegally detained by the Canadian side for more than one thousand days, finally returned home safely. The phrase "If faith has color, it must be China Red" expresses the common aspiration of 1.4 billion people in China.

Since the 18th National Congress of the Communist Party of China, China has practiced the concept of diplomacy for the people, rooted in, cared for and benefited the people, and firmly safeguarded the legitimate rights and interests of Chinese overseas citizens and legal persons.

To build an overseas livelihood project, China’s diplomacy is committed to weaving a safety net for China citizens and enterprises going abroad, providing a safer travel environment for overseas China tourists, striving for a better study environment for China students, creating a more friendly business environment for China businessmen, bringing warmer care to overseas Chinese in China, finding a broader market for China goods, creating better working and living conditions for China workers overseas, and helping them realize their dreams.

During the five years from 2012 to 2017, China successfully organized nine evacuation operations for overseas citizens, handled more than 100 cases of China citizens being kidnapped or attacked abroad, and accepted nearly 300,000 cases of consular protection and assistance.

On March 29th, 2015, the 19th escort formation of China Navy, Linyi Ship, arrived in Aden Port, Yemen, and the female crew of Linyi Ship helped the evacuated children board the ship. Xinhua News Agency (photo by Xiong Libing)

In 2020, the COVID-19 epidemic spread all over the world. The Party and the government always cared about the safety of overseas China citizens, tried every means to ensure the health, safety and working life of China citizens, and distributed "health packages" and "Spring Festival packages" to overseas students and overseas Chinese to help China citizens with real difficulties return to China in an orderly manner; Carry out the "Spring Seedling Action" and actively strive for and assist overseas China citizens to vaccinate.

The 24-hour "12308" consular protection hotline, embassies and consulates all over the world, and the global risk assessment and early warning service & HELIP; … From the moment they stepped out of the country, China citizens always had the protection of the motherland behind them.

Promote global governance reform and create more favorable conditions for China’s development and world peace.

Autumn colors are first dyed, and the Qiantang River is surging.

In September 2016, G 20 leaders gathered in Hangzhou, Zhejiang. Chairman of the Supreme Leader presided over the summit and comprehensively expounded China’s view of global economic governance for the first time — — Based on equality, oriented by openness, driven by cooperation and aimed at sharing. The summit promoted the transformation of the G20 from short-term policies to medium-and long-term policies, and from crisis response to long-term governance mechanisms.

On January 16th, 2021, in Belgrade, the Serbian capital, airport staff unloaded the COVID-19 vaccine produced by China Sinopharm Group. Xinhua News Agency (photo by Predrag milosavljevic)

With the increasing changes in international power and global challenges, strengthening global governance and promoting the reform of the global governance system have become the general trend.

From APEC leaders’ meeting in Beijing to G20 leaders’ meeting in Hangzhou, from SCO summit in Qingdao to BRICS leaders’ meeting, from "Belt and Road" international cooperation summit forum to China-Africa cooperation forum in Beijing, from Boao Forum for Asia to the Conference on Dialogue of Asian Civilizations, the Communist Party of China (CPC) and the leaders of world political parties, and the first phase meeting of the 15th Conference of the Parties to the Convention on Biological Diversity & HELIP; … A series of major home diplomacy has become a shining business card of China’s diplomacy in the new era, reflecting the glorious course of China’s active participation in global governance.

This is the logo of the Asian Infrastructure Investment Bank (AIIB) photographed on October 25th, 2021. Xinhua News Agency reporter Li Heshe

Advocate the concept of global governance, adhere to the concept of common, comprehensive, cooperative and sustainable security, constructively participate in the political settlement of international and regional hot issues, constructively participate in global climate governance, promote the strengthening of global public health governance, initiate the establishment of Asian infrastructure investment bank and new development bank, and put forward the global development initiative and global security initiative & HELIP; … A series of new ideas, new ideas, new initiatives, and concrete plans and actions have contributed China’s wisdom and injected action into solving various problems faced by mankind, demonstrating China’s diplomacy as a great power in the new era.

On October 14, 2021, the staff transported the Kexing COVID-19 vaccine that the government of China assisted Cambodia at Phnom Penh International Airport, Cambodia. Xinhua News Agency (photo by Pi Long)

On May 7th, 2021, a medical expert group of China government visited a sampling site in Covid-19 in Vientiane, the capital of Laos, to learn about the sampling process, information collection, criteria for judging close contacts and environmental disinfection. Xinhua News Agency (Photo courtesy of the China Municipal Government Medical Expert Group)

On August 21st, 2020, in a Covid-19 testing institution in Juba, the capital of South Sudan, members of China’s anti-epidemic medical expert group communicated with local medical staff. Xinhua News Agency (Photo courtesy of China Embassy in South Sudan)

On January 19th, 2021, medical staff vaccinated an indigenous person with China COVID-19 vaccine in Tabatinga, Brazilian Amazon. Xinhua News Agency (photo by Lucio tavola)

"There are many and huge world problems, and global challenges are rising day by day, which should and can only be solved through dialogue and cooperation. International affairs are discussed by everyone, and helping each other in the same boat has become a broad consensus of the international community. " The speech made by the Chairman of the Supreme Leader at the 75th anniversary summit of the founding of the United Nations showed the profound thinking of China leaders on promoting the reform of the international governance system.

Facing the future, China has placed its own development in the grand coordinate system of human development, and has always been a builder of world peace, a contributor to global development, a defender of the international order and a provider of public goods, working hand in hand with people from all countries to help each other and courageously move forward towards the goal of building a community of human destiny.

Reporter: License, Ma Zhuoyan, Cheng Xin

Poster design: Yin Zhelun

New Media Editor: Wu Jinfu